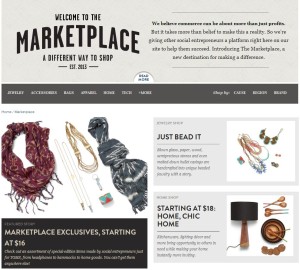

TOMS Launches Marketplace, Roasting Co.; Continues To Build on Social Good Promise

TOMS Launches Marketplace, Roasting Co.; Continues To Build on Social Good Promise

10 million pairs of shoes to children in need.

150,000 people have had their sight restored.

And now?

One of TOMS’ latest ventures, Marketplace, brings 30 socially conscious brands together via a platform to help them succeed. Committed to give back to their communities, each brand is working to make a difference to use business to improve people’s lives. With over hundreds of items to choose from, TOMS offers its community the innovative opportunity to shop by cause or even the region they wish to help.

But that wasn’t enough… Earlier this month, the company launched TOMS Roasting Co. Remaining committed to its One for One® mantra and in partnership with Water for People, for every bag of coffee TOMS sells, a person in need will receive a week of clean water. Let that sink in for a second… An estimated 1.8 billion people are drinking unsafe water. When you buy a $12.99 bag of coffee, someone will get something we take for granted every.single.day.

It’s remarkable, really, to see a company able to thrive by making an impact on communities worldwide. Not only thrive, but build a brand for itself that other companies strive to emulate. With so much focus on shopping local and doing good, this is a branding trend I’m happy to follow, and personally, I can’t wait to see what TOMS comes up with next.

# # #

Source

“One for One,” TOMS.com, https://www.toms.com/our-movement/l

Top 10 Halloween Candy Brands

Happy Halloween brandsalsa readers! In spirit of today’s sugar-filled, ghoulish holiday we thought we’d countdown America’s top 10 Halloween candy. All of the data is from a market research study performed by the market research firm, Information Resources Inc.

It is interesting to see that eight of the 10 brands on this list first debuted before 1950. While in most industries newer is always better the opposite is true when it comes to our favorite candies.

Here is America’s top 10 Halloween candies, I dare you to make it through the post without running over to the office candy stash:

10. Almond Joy

Sales: $82.25 million

Unit sales: 79.39 million

Average price per unit: $1.04

Introduced: 1946

Company: Hershey Co.

Almond Joy was introduced in 1946 as a version of the Peter Paul Mounds chocolate bar. Peter Paul merged with Cadbury Schweppes in 1978, and roughly 10 years later, Hershey acquired the company’s U.S. business. In the past 12 months, the brand was one of just 10 to sell more than $80 million in the under 3.5 oz. bar category, the size customers typically buy at the checkout line in a grocery store or supermarket.

9. Milky Way

Sales: $93.46 million

Unit sales: 90.83 million

Average price per unit: $1.03

Introduced: 1923

Company: Mars Inc.

Mars has been selling Milky Way bars since 1923. The bar is not directly named after the galaxy containing our solar system, as some believe, but after a once-popular malted milk shake. In the past year, sales of standard-sized Milky Way bars rose by more than 5% to $93.4 million. This made the brand the only one of the company’s top-sellers that did not lose market share over that time, based on IRI data. Sales of snack-sized Milky Way, typically popular around Halloween for trick-or-treaters, rose by more than 10%.

8. Hershey’s Cookies ‘N’ Creme

Sales: $100.70 million

Unit sales: 98.92 million

Average price per unit: $1.02

Introduced: 1994

Company: Hershey Co.

Hershey’s Cookies ‘N’ Creme bar, introduced in 1994, is actually a relatively new addition to Hershey’s line of chocolate brands. It is also one of just eight brands to record sales of more than $100 million in the most recently available 52-week period. However, dollar sales of the brand were relatively flat over the past 52 weeks, rising roughly 1.7% — too little to gain market share. By comparison, dollar sales of all Hershey standard-size brands rose by roughly 9%.

7. 3 Musketeers

Sales: $101.27 million

Unit sales: 90.79 million

Average price per unit: $1.12

Introduced: 1932

Company: Mars Inc.

Over the past year, sales of 3 Musketeers bars fell by 9.6% to just over $101 million, the second-largest drop of any major chocolate candy bar. Dollar sales of snack-sized 3 Musketeers also fell by about 4%. One potential explanation for the brand’s decline in sales may be less advertising. In March, Ad Week reported that “media spending on 3 Musketeers exceeded $6 million last year, down from about $15 million in 2011 and more than $17 million in 2010, according to Nielsen.” Mars has sold 3 Musketeers bars since 1932.

6. Twix 4 To Go

Sales: $116.13 million

Unit sales: 74.49 million

Average price per unit: $1.56

Introduced: 1993

Company: Mars Inc.

Mars sold over $116 million of Twix 4 To Go bars, compared to just over $80 million of the traditional Twix bar over the most recently available 52 weeks. However, the standard Twix, which contains two cookie bars, still sold close to 88 million units, while Twix 4 To Go, containing four cookie bars, sold just under 75 million units. The difference was made up in the price. Twix 4 To Go costs an average of $1.56, the most expensive top-selling chocolate candy and more than 60 cents more than the average Twix bar.

5. Kit Kat

Sales: $306.51 million

Unit sales: 275.88 million

Average price per unit: $1.11

Introduced: 1935

Company: Hershey Co.

Sales of few chocolate bars grew faster than Kit Kats over the past year. In that time, the number of Kit Kat bars sold rose 17.8%, while dollar sales rose by more than 22%. Recently, Kit Kat launched a co-promotion with Google, which code-named the most recent version of its Android operating system “KitKat.” The Kit Kat brand, owned by Nestle, is popular worldwide. The Hershey Company, however, licenses and manufactures the chocolate in the United States.

4. Hershey’s

Sales: $324.63 million

Unit sales: 308.42 million

Average price per unit: $1.05

Introduced: 1900

Company: Hershey Co.

Hershey has been making many of its most famous brands for decades, and it has made Hershey’s branded milk chocolate bars since 1900. Although most of the company’s brands have been around for quite a while, Hershey is planning to introduce its first new U.S. brand in decades in 2014. Sales of the company’s long-standing brands have risen recently, mostly because of advertising pushes. According to IRI, sales of standard-size Hershey’s-branded chocolate bars rose by nearly 8% in dollar terms and 7% in unit terms. The brand’s dollar sales for snack sizes, popular around Halloween, have also increased by nearly 12%.

3. Snickers

Sales: $456.91 million

Unit sales: 412.81 million

Average price per unit: $1.11

Introduced: 1930

Company: Mars Inc.

Snickers bar sales fell by more than 7% to just under 413 million units in the most recent 52 weeks available. This mirrored the decline in the under 3.5 oz category Mars faced across all of its brands, for which unit sales fell by 7.7%. Snickers has been around since 1930, and in recent years has made a major advertising push with its celebrity-filled, “You’re not you when you’re hungry,” campaign. The first commercial in the campaign, which aired during the 2010 Super Bowl, featured actress Betty White getting tackled in a backyard football game. It was an instant sensation.

2. M&M’s

Sales: $500.82 million

Unit sales: 435.18 million

Average price per unit: $1.15

Introduced: 1941

Company: Mars Inc.

Sales of M&M’s only trail sales of top chocolate brand Reese’s by a small amount. But the brand lost its position as the best-selling chocolate after sales fell by more than 3% during the 52 weeks ending in early September. In terms of total units sold, M&M’s did even worse, with unit sales down 7.5% from the same period the year before. M&M’s also may not see the same sales boost other candy makers see during the Halloween season. Although it is the second highest selling regular size candy, it ranks only eighth among brands in snack-sized sales.

1. Reese’s

Sales: $509.85 million

Unit sales: 407.44 million

Average price per unit: $1.25

Introduced: 1928

Company: Hershey Co.

Reese’s regular size (less than 3.5 oz) peanut butter cups jumped by 7.7% to just under $510 million in the past year, outstripping M&M’s from its top spot as the best-selling chocolate. As a result, the brand overtook M&M’s as the nation’s best-selling chocolate candy. Overall, with Reese’s and several other major brands sales growing over the past 12 months, the Hershey Company dominated the market for standard-size chocolate candy, accounting for roughly 49% of customer spending. Halloween marks a major sales opportunity for Reese’s as well. The brand leads in sales of snack-sized packages, which are often given out to trick-or-treaters.

Source:

America’s Favorite Halloween Candy

Brands We Love: Gatorade

There are few brands that can disrupt a market or industry, or create a need that consumers don’t even know they wanted in the first place. We all know the stories behind some of these brands - Apple does it regularly; Dyson and Chobani are also brands that get lumped into this category. But, a brand that is almost always overlooked as a game changer is Gatorade. Like the brands mentioned before, Gatorade created a product that, at the same time, launched a new industry: the sports drink industry.

Gatorade is a brand that has long been a staple on the sidelines of sports fields and has mastered its brand’s story and application of the brand in relevant areas. Through sponsorships, innovative sports research and athlete endorsements Gatorade has catapulted itself from a homemade concoction to a well-respected brand.

Gatorade’s History:

It may be a surprise to some, but this industry-leading drink has very humble beginnings dating back to 1965 in Gainesville, Florida, home of the Florida Gators. The original sports drink was formulated by a team of researchers at the University of Florida College of Medicine, including Robert Cade, Dana Shires, Harry James Free and Alejandro de Quesada. It was created following a request from Florida Gators’ football head coach Ray Graves to aid athletes by acting as a hydrating replacement for body fluids lost during physical exertion in hot weather. The earliest versions of the beverage consisted of a mixture of water, sodium, sugar, potassium, phosphate and lemon juice. Ten players on the University of Florida football team tested the first version of Gatorade during practices and games in 1965, and the tests were deemed successful. The football team credited Gatorade as having contributed to their first Orange Bowl win over the Georgia Tech Yellow Jackets in 1967, at which point the drink gained traction within the athletic community. Yellow Jackets coach Bobby Dodd, when asked why his team lost, replied: "We didn't have Gatorade. That made the difference."

Gatorade’s Brand Power:

The name Gatorade has become synonymous with sports nutrition, research, elite athletes and winning championships. Gatorade has attached its name to some of the most recognizable and respected athletes such as Michael Jordan, Mia Hamm, Dwayne Wade and Peyton Manning. But perhaps one of the strongest brand ties Gatorade has with consumers is the “Gatorade dunk,” first popularized by the 1985 New York Giants. From a brand exposure standpoint, the tradition of dumping a Gatorade cooler on a winning coach’s head after a big game is the type of un-paid, highly impactful and visual exposure any brand craves, and reinforces how engrained the Gatorade brand is in American sports.

Gatorade is currently manufactured by PepsiCo and distributed in over 80 countries. Gatorade commands 46% of the worldwide sports drink market according to Euromonitor International. In 2010, Gatorade re-branded a number of its products. Original Gatorade was initially re-labeled as Gatorade G. Gatorade Rain was re-labeled as No Excuses. Gatorade AM was re-labeled Shine On; Gatorade X-Factor was relabeled as Be Tough; and Gatorade Fierce was relabeled Bring It. However these names were short-lived, as a two percent decline in market share in 2009 led to a broader repositioning of the entire line in 2010. Beginning in February 2010, the Gatorade product portfolio was re-positioned around what the company refers to as the G Series, categorizing varieties of its products into three main segments: before, during, and after athletic events.

Gatorade is one of four beverage brands on Forbes Most Powerful Brands list. Overall, Gatorade is ranked 86th on the list with a brand value of 4.8 billion. Gatorade is the only sports specific beverage on the list, and I don’t foresee another sports drink chipping away at Gatorade’s brand power, but as always it will be interesting to see where Gatorade lands next year on the annual report published by Forbes.

Sources:

The Gatorade Company Fact Sheet

Gatorade

Gatorade’s G Force Leaves No Sweat Behind

The World’s Most Powerful Brands

Brands are Gearing Up for NFL Kickoff

Today the calendar reads September 5, 2013, but that’s nothing more than a technicality. We all know what today really is, the start of the NFL football season. After its annual eight month hiatus from our TV screens and branded products on our grocery store shelves, it’sback. And, the only ones more ready than the players, fans, and coaches are the brands who each year enter into lucrative partnerships with the most profitable and recognizable sporting organization out there, the NFL.

Exclusive and official partnerships with the NFL are a big business, and often times the pinnacle of the participating brand’s strategy each year. According to Turnkey Sports & Entertainment in its annual NFL sponsorship awareness survey, more than one-third of the group surveyed said they are more likely to recommend a product/service to a friend or family member and consciously support a company because their products/services are an official sponsor of the NFL.

Starting today and continuing through the weekend, more than 105 million viewers are expected to tune into an NFL game. A lot of brands invest in campaigns and strategies to capture the attention of the viewers, but today we’ll look at three of the most heavily invested brands and what their partnerships with the NFL have meant for their businesses.

Pepsi

As the largest food and beverage company, it’s no wonder Pepsi is an exclusive partner of the NFL. Pepsi has been developing fresh creative that will start to be unveiled during tonight’s kickoff game.

New this year for Pepsi: the brand will feature all 32 teams on point-of-sale materials and include each Pepsi variety in NFL advertising (Pepsi Max, Diet Pepsi, etc.)Pepsi’s contract has long allowed it to use all 32 teams and logos in promotional materials, but it has never taken advantage of the benefit until now.

This year’s Pepsi campaign will tell a season-long story led by the call to action, “Are you fan enough?” Angelique Krembs, VP-marketing for trademark Pepsi, said Pepsi worked closely with the NFL and asked consumers how they felt about different periods of the season, which led to this campaign idea.

As an NFL fan, I understand that our feelings about the season change as the weeks go on, so I am excited to see how Pepsi wraps these common fan feelings into a campaign. NFL fans tend to connect to the advertisements that capture what it’s like to be a fan, good or bad, so I suspect these ads will be a big hit among viewers.

Bud Light

Perhaps no brands are more synonymous with the NFL than Anheuser-Busch and Bud Light. Anheuser-Busch has held exclusive alcohol advertising rights for the Super Bowl for 22 years. But, it’s interesting to point out Bud Light has only had an exclusive partnership with the NFL since 2011. Stretching from 2001-2010, MillerCoors enjoyed the exclusive partnership, and prior to that, the two shared advertising rights.

Bud Light’s exclusive partnership with the NFL certainly seems to be paying off. The NFL sponsorship survey mentioned above found that NFL fans provide Bud Light with its highest recognition scores out of all of Bud Light’s official partnerships. In 2012, the high recognition scores can be attributed to the fact that in addition to its blanket deal with the NFL, Bud Light has local sponsorship agreements in place with 28 of the league’s 32 franchises. Along with the TV spots, the brewer rolled out specially marked 12-packs packaged in a material that looked and felt like pebbled pigskin. The cans also featured the NFL shield and the local team’s logo.

For 2013, Bud Light will launch a series of new spots called “Dilemmas” that highlight the lengths fans go to help their team win. To me, this feels very similar to their highly successful “Superstitious” series that ran last year with the now famous tagline “it’s only weird if it doesn’t work.” But, if executed well, this could be a fun extension of the “Superstitious” series, and could help build on the emotional attachments and equity that last year’s campaign built.

Papa John's

Last up is Papa John’s. After the 2012 NFL season, more than 62 percent of avid NFL fans correctly identified Papa John’s as the official pizza of the NFL, a 13 percent increase from the year before. The increase in Turnkey’s report was the largest change among all 68 brands measured in the survey and seems to be the most perplexing to me. Compared to the other brands mentioned (or not mentioned) in this post, Papa John’s advertising and sponsorship seems to be the least memorable. But perhaps the recognition is partly due to the fact that pizza is a less competitive and crowded space on the advertising scene compared to others. Nonetheless, Papa John’s exclusive partnership with the NFL and its Peyton Manning TV spots are working. Before the start of the 2013-14 season, Papa John’s entered into a new, long-term brand partnership with the NFL.

___

With tonight’s NFL kickoff, it will be fun to watch how each brand approaches its season-long campaign. At the end of the 2013-14 season, we’ll revisit this post and discuss what brands made the biggest impact on the season through its advertising and promotions.

Sources:

NFL Prods Partners Into Kicking Off Season with Fresh Creative

Avid fans know their NFL sponsors

Pepsi's NFL Sponsorship To Star All 32 Teams

Bud Light to be official beer sponsor

Bud Light Suits Up for 2012 NFL Season Heavy TV spend marks second year of official sponsorship

Making Your Mark: Tattooing as a Form of Self-Branding

We all find ways to “brand” ourselves on a daily basis. Just as companies send messages about who they are and what they stand for by using a carefully chosen name, slogan, or logo, we make our own personal statements with the clothes we wear, the places we frequent, the music we listen to, and even the Facebook statuses we post. And yet, much of these exterior signs are subtle and can be changed at the drop of a hat; we can buy new clothes, find new haunts, or change the types of media we consume. So how can one escape the ephemeral nature of self-expression and communicate his or her own personal brand in a lasting way? For some, the answer has come in the form of one or more tattoos.

Tattooing in its various forms has been around since the time of Ancient Greeks, and was explicitly documented in the United States as early as the Civil War (when soldiers would ink up to demonstrate their allegiances). While many of the tattoos of ancient times were compulsory methods of state control, used to mark slaves and criminals, the tattoo has slowly evolved to become a popular and in most cases, voluntary form of self-expression. Today, about twenty percent of all Americans sport at least one tattoo, while the tattooing industry rakes in an annual revenue of $2.3 billion as of 2012.

I began thinking about tattooing as a form of self-branding after my roommate decided to get inked up about a month ago, after years of contemplation, designing and waiting for the right moment. She came back with two tattoos: one was butterfly perched between her shoulders, and the other was a single word, “Desiderata,” written in her own handwriting across the nape of her neck. The butterfly, she explained, is her spirit animal (beautiful, free, yet fragile), made all the more meaningful by the fact that the design was created for her by a dear friend. The word desiderata, meaning things that are desired or essential, is the title of one of her favorite Max Ehrmann poems (read it here). Both tattoos represent symbols and ideas that deeply resonate with her, and provide the odd passerby with an outward glimpse of the personality within. For her, the tattoos create a personal brand of serenity, optimism, and perseverance in the face of obstacles.

According to Jill Fisher, Assistant Professor of Social Medicine at UNC Chapel Hill and author of Tattooing the Body, Marking Culture, people tattoo themselves for multiple reasons, including to mark an important life event, to show group identification or membership or to add personal decoration. Indeed, I’ve heard many tattoo bearers speak of their bodies as a canvas, on which they can place words and images that speak to them, whether it be on an aesthetic, emotional or intellectual level.

Some take this to the extreme, as with the case of model and performing artist, Rick Genest, famously known as “Zombie Boy.” His tattoos, designed to make him look like a member of the living dead, cover more than 80 percent of his body, and help create an incredibly unique personal brand, described as, “effortlessly cool and darkly glamorous…a chiaroscuro of both light and dark—part gentle warrior, part anti-establishment artful dodger…”

He refers to his tattoos as an ongoing personal project that he’s determined to finish, and it has garnered him much public attention (he even appeared alongside Lady Gaga in her “Born This Way” music video). Since his discovery and ensuing fame, he has even come out with Zombie Boy merchandise, including skull rings, combat boots, leather purses and biker helmets. While some tattoo bearers brand themselves to align with an already-established brand (think Twilight or sports tattoos), Zombie Boy has done the exact opposite, creating his own brand that eventually branched out into the larger public arena. That said, you don’t have to look at such rare examples to realize the potential in using the body as a way to share an idea or cultivate an image.

I have asked others why they chose to go under the needle, and the responses have been at times touching, surprising or even amusing. But, I have always learned something more about the person as a result. One of my supervisors told me his tattoo—a fleur-de-lis with a cancer awareness ribbon wrapped around it—symbolizes the Holy Trinity and commemorates a cousin who died of cancer. A friend got a Deathly Hallows symbol because she loves Harry Potter. A coworker, who has the beginnings of sleeves (tattoos running down the arms), told me that the last time he went into the parlor, he held out his arm and said to the tattoo artist, “Surprise me,” because he loves the experience and the euphoric rush that follows the pain.

Even when the tattoo doesn’t necessarily have profound meaning, as in the latter two cases, it can still suggest something about their interests, loyalties or adrenaline-seeking tendencies. In my first example, I see my supervisor’s personal brand as one of thoughtfulness, familial loyalty and spiritual contemplation. For my friend, I see a brand of devoted fandom and child-like excitement. And, in the case of my coworker (who is also an EMT and volunteer firefighter), I see spontaneity, boldness and a love of risk-taking.

However, it is true that the brand the “tattooee” sees is not necessarily the brand others see. In a society where tattoos are still somewhat stigmatized—and often associated with criminality or social deviance—many people look at a tattoo and automatically see a brand of rebellion, recklessness, stupidity or even danger, regardless of the design. Even those who are more open-minded might misconstrue the purpose or meaning behind a tattoo at first glance.

And so, tattoos present the wearer and observer with an intriguing dichotomy; while it is one of the most obvious visual forms of self-branding, it is also unlikely that the viewer will fully understand or appreciate the brand unless he or she talks to the bearer. It appears that the expression, “don’t judge a book by its cover,” still applies, even if the book comes with illustrations.

Contributed by Rachel Loucks

Sources:

“America’s booming tattoo economy: By the numbers.” Staff, The Week, https://theweek.com/article/index/233633/the-tattoo-economy-by-the-numbers

“Interview With Rick Genest, the Zombie Boy.” Alessandra Codinha, Women’s Wear Daily, https://www.wwd.com/eye/people/the-zombie-boy-survival-guide-5973051

“Tattooing the Body, Marking Culture.” Jill Fisher, Body & Society, https://www.jillfisher.net/papers/body_and_society.pdf

“Zombie Boy: Story.” https://rickgenest.com/index.php?option=com_content&view=article&id=59&Itemid=113

Embrace the Shake

We’d love to think of ourselves as being unlimited, but in reality that isn’t true for most. This can apply to your personal self or to your company/brand. At Addison Whitney, our clients vary greatly, and with each client there are going to be certain limitations we face and must work around – some clients face stronger regulatory guidelines, others have smaller budgets. Whatever it is, we find a way to work with them and around those limitations. And, we approach each project looking at what could be, versus what is, always developing creative deliverables above and beyond what our client could have imagined. Approaching every project this way is at the very core of who we are.

For today’s post, I wanted to do something a little different and share a great video I saw from a TED talk in February. There are a number of messages you can take away from the video, but the primary message Phil Hansen (the speaker) shares is that by sometimes thinking inside the box – and not out, like we’re usually told –your creativity may break out in ways you haven’t seen before. In other words, using your limitations, not as barriers, but as the foundation for creating something, can produce amazing results.

Take a look at this video, and watch how Phil works through his limitations to “embrace the shake,” and in turn, unleash his creativity.

On Target: New 'Simply Balanced' Brand

While wandering around Target this weekend, I stumbled across a shiny, new brand, ‘Simply Balanced.’ Intrigued by the clean packaging, I wondered out loud, “What is this? I haven’t seen this brand before.” A Target employee was working in the same aisle and gave me a quick history lesson- the cleaner, fresh brand was replacing Archer Farms Simply Balanced line. (Confession: In all of my Target shopping, I never noticed an Archer Farms sub-brand product line, so I immediately felt the introduction of a stand-alone brand, separate from Archer Farms, was a good idea.)

When I came into work this morning, I did some digging on the new line. It looks like the brand was officially launched last month “…in response to the growing popularity of organic foods.”

The products include wholesome ingredients, and more than 40 percent of the assortment is organic. There are no products with hydrogenated or partially hydrogenated oils, high-fructose corn syrup, synthetic colors, artificial preservatives, artificial flavors or artificial sweeteners. And, the majority of Simply Balanced items are made without genetically modified organisms (GMOs).

From a brand perspective, this reflects a broader push by supermarkets and big-box retailers to improve the image of their store brands. Consumers have become increasingly accepting of store brands not merely as good values, but as just plain good. And they’re willing to pay more, at least compared with the old no-name brands of the past.

So, why did this brand catch my eye? At the simplest glance, the packaging has gotten a complete overhaul.

From old…

…to new…

And of course, one look at the ingredients made me quite happy to see Target committing to healthier food options.

To ensure understanding, Target has gone a step further and created frequently asked questions about the Simply Balanced brand. The positioning statement is clear and concise: The heart of the Simply Balanced brand is that it’s great-tasting, wholesome food with simple and recognizable ingredients.

And, Target’s site has a section dedicated to Simply Balanced. There are recipes using Simply Balanced products, as well as money-saving coupons.

We’ve written about private label brands several times on this blog, and I think this is a bit of a peek into the future. The bland, lower quality, boring store brands are history, and new, swankier, smarter brands are becoming a reality.

Sources

“Simply Balanced: Target’s wellness grocery brand,” Corporate.Target.com, https://goo.gl/15VNL

“Target To Launch Organic 'Simply Balanced' Brand,” HuffingtonPost.com, AP, https://goo.gl/FXBUf

“The Rise of the Swanky No-Name Brand,” Business.Time.com, Brad Tuttle, https://goo.gl/KLT9R

“Simply Balanced: Frequently Asked Questions,” Target.com, https://goo.gl/HGQR9

“Introducing Simply Balanced,” Target.com, https://goo.gl/0NjMf

Brands We Love: Kia

Earlier this week while I was perusing Twitter, I noticed a large number of tweets surrounding an unlikely brand, Kia, and being a strong advocate of the brand, I was immediately intrigued. Though I hold it close to my heart and tell anybody who wants to listen how much I love Kia, I also know it’s typically not a highly talked about brand. So as you can imagine, I began to investigate the reason why. As it turns out, Kia made its debut this week on Interbrand’s 2013 Best Global Green Brands, which is Interbrand’s nod to the top ethical and ecologically responsible brands.

My affinity for the Kia brand began seven years ago, when I bought my Kia Sorento. Kia was in the process of repositioning itself in the American market from a not-so-glamorous automaker to a polished, design savvy one, all while still being an affordable option for American drivers. I’d like to think I was ahead of the curve when it came to Kia, but as it turns out I was fully falling into its plan of becoming a well-recognized and respected brand in America, and I don’t mind that one bit.

Instead of listing all the reasons why I love the Kia brand (and trust me, there are a lot), let’s take a look back at the brand’s history and how it has become one of the most valuable brands.

Kia’s storied past

Kia, South Korea's oldest car company, was founded on June 9, 1944 as a manufacturer of steel tubing and bicycle parts. In 1951, Kia switched gears a bit (pun intended) and began building complete bicycles. In 1952, Kia changed its name from Kyungsung Precision Industry and later built motorcycles (starting in 1957), trucks (1962) and cars (1974).

It wasn’t until 1992, that Kia Motors America was incorporated in the United States. Kia began sales operations in Portland, Oregon at four dealerships. Since then, Kia has expanded methodically, one region at a time. Fast forward to 2013, and Kia is the fourth largest automotive group in the world.

The Kia brand

When I began researching the Kia brand a bit more for this blog post, I was extremely happy to see that Kia’s website outlines its corporate identity.

One of the most fascinating aspects of the brand is its name, Kia. Without knowing when the name was chosen, its fascinating to see how the company’s success has mirrored the meaning of its name .

According to Kia’s website, the word Kia is derived from the Chinese letter “Ki,” meaning to “arise or come out of” and “a,” referring to Asia. When the two words come together Kia means to “arise or come out up out of Asia.”

Kia has emerged as one of the fastest-growing automobile brands, and it doesn’t appear to be slowing down anytime soon. The brand’s success has been attributed to its connection with millennials and Gen Y audiences by promoting uses of technology and connectivity that appeal to younger audiences. As a strong advocate for the Kia brand and self-proclaimed Kia driver for life, I’m excited to see how it responds to its growing popularity.

Sources:

Kia Corporate Website

Kia Motors enters Interbrand’s list of 50 best global green brands 2013

Refining the Hyundai-Kia brand plan

Branding Pharmaceutical Drugs in China

Did you know according to the Chinese Association for Pharmaceutical Equipment group that the Chinese pharmaceutical industry has been growing at an average annual rate of 16.72% over the last few decades?

And that growth isn’t going to slow down anytime soon.

China stands at the cusp of a modern society with an increasingly affluent and growing population. And it’s this growing population that is demanding better services and quality of life – but how will this impact the pharmaceutical industry in China – particularly in regards to branded pharmaceutical drugs?

Not just in the pharmaceutical industry, but for all industries across the board, China has become the must win market. An aging population, increasingly affluent younger population, and the rise of diseases in China all create an emerging need for drugs, which is why The IMS Institute has predicted that by 2016 China will overtake Japan as the second largest pharmaceutical market in the world. So it’s no wonder why billions of dollars a year are being invested in the country.

Many foreign players such as AstraZeneca, Pfizer, Bayer and GSKhave already established themselves firmly in the market and are expanding their services regularly within the country. But with the entry of foreign players in the industry, the competition amongst these players will continue to increase. China has more than 5,000 pharma companies, and in 2010 was the leading country filing pharmaceutical trademarks – even beating out the United States, one of the most mature pharmaceutical markets by nearly 10,000 trademarks filed. Even though China is the global leader filing pharmaceutical trademarks, the majority of the drugs manufactured in China are generic. But as China’s consumer mindset continues to mature and grow, so will the branded pharmaceutical sector.

Why the continued growth?

Specifically for pharmaceuticals, powerful product brand names are important tools to offset competitive pressure from generics and to build customer loyalty. Though heavily regulated by state legislations, in China’s case the SFDA, brand naming for pharmaceutical products is unique, and can greatly affect marketing decisions.

In highly competitive environments, a strong brand will rise above the clutter and demand attention. With a strong brand, you secure a unique position of credibility in the consumer mind, have more influence on your market and motivate customers to purchase from you.

From a marketing perspective, brand naming for a pharmaceutical product may take into consideration aspects such as the chemical/biological nature of its active ingredient, composition/formulation, therapeutic indication, associated medical condition, benefit and adherence to the corporate identity.

From a communication point of view, pharmaceutical branding specialists must decide whether to focus on the functionality or the end-user benefits. It is also from the same angle that pharmaceutical naming is usually considered of great complexity, as most of the time, both audiences should be targeted.

Chinese regulations on pharmaceutical drug naming frown upon utilization of characters that are either indicative of curative effect, intended use, target audience or may imply efficacy.

Regardless of the market you’re in, developing a strong pharmaceutical name is tough, but in China it can be particularly challenging. You must keep in mind translations, the use of characters and regulatory conditions. Biological and pharmaceutical products rely heavily on the protection of intellectual property rights, so it’s essential for foreign companies to gain thorough understanding of China’s IPR protection system before entering the market.

Multinational companies have greatly expanded their businesses in China over the years and have aligned with local pharmaceutical companies, which has proven to be a winning strategy for both parties. And as these companies and other foreign players continue to expand their footprint in China, competition will become fierce as each seeks to penetrate the market. Pricing, intricate knowledge of regional markets and developing strong brands will determine who gets ahead and who doesn’t.

Neuromarketing: You don’t know what you don’t know

Neuromarketing, an upcoming discipline, is directed towards a detailed attempt in understanding the consumer decision making process. Unlike traditional market research methodologies, which are dependent on a respondents’ ability to accurately describe their thought process, neuromarketing is a process that analyzes a person’s sensorimotor, cognitive and affective response to marketing stimuli. By monitoring parts of the brain during the consumer decision making process, researchers are able to identify which parts of the brain are responsible for what.

The idea of monitoring brain waves to understand the decision making process was first brought forth by economists – coining the term, neuroeconomics. In recent years, marketers have taken to this research to understand the decision making process against marketing stimuli. Most commonly, researchers work with advertising pieces and analyze how various manners effect memory. Ultimately though, analyzing the connection between neuro activity and brands is what brought neuromarketing to the main stage.

In 2004, functional brain waves (fMRI) were monitored during a Coke vs. Pepsi taste test. This study, from the group of Read Montague published in 2004, conducted two tests, one blind and another labeled. During both, researchers monitored two areas of the brain -- the ventromedial prefrontal cortex (VMPFC), which processes information on sensory information, and the hippocampus dorsolateral prefrontal cortex, which is the part of the brain that uses sensory and cultural influence when processing information. Researchers believed the cultural consideration would bias Coke and its stronger brand history. After both studies were done, the blinded and labeled taste test, researchers concluded a preference for a brand is easily changed based on stimuli presented. During the blind test, respondents utilized the VMPFC and based solely on sensory information (taste), the two sodas tested relatively similar. However, once the label was presented, Coke benefited from the hippocampus and the strong brand presence Coke had achieved. This combination helped push Coke into the winner’s circle.

Today, neuromarketing is all about understanding how the hippocampus develops within each one of our brains, something that is commonly referred to as a meme. A meme is a value, understanding, emotional trait, etc.., passed throughout a culture, brought to existence by Richard Dawkins in his 1976 book, The Selfish Gene. Fashion trends, musical hits, and charitable involvement are all examples of memes. Various industry leaders have taken to this technology, with Google, CBS, and Frito-Lay having submitted their ads and products for analysis. These companies are eager to progress this science because they know the vast majority of decision variables are weighed sub-consciously. Therefore, being able to get a clear picture into which stimuli trigger what, will form a race to understand what it means. From there, an even greater race will follow -- The race to apply this knowledge.

Contributed by: Chris Rupp

Sources:

1 Karmarkar, Uma R. (2011). "Note on Neuromarketing". Harvard Business School (9-512-031).

2 David Lewis & Darren Brigder (July/August 2005)."Market Researchers make Increasing use of Brain Imaging". Advances in Clinical Neuroscience and Rehabilitation 5 (3): 35

3 Blackmore, Dr. Susan (Feb. 2008/June 2008): Susan Blackmore: Memes and ‘temes’. TED2008. https://www.ted.com/talks/susan_blackmore_on_memes_and_temes.html

4McClure SM, Li J, Tomlin D, Cypert KS, Montague LM, Montague PR

(2004) Neural correlates of behavioral preference for culturally familiar drinks. Neuron, 44: 379-387.

5 Zineb Ouazzani Touhami1,2*, Larbi Benlafkih1, Mohamed Jiddane3,5, Yahya Cherrah5, Hadj

Omar EL Malki2,5,6 and Ali Benomar2,4,5,6; Neuromarketing: Where marketing and neuroscience meet. November 2010. https://www.academicjournals.org/ajbm/pdf/pdf2011/4Mar/Touhami%20et%20al.pdf